Welcome to this week’s edition of 2Jour Gazette—your curated look at what’s been making waves in fashion and luxury.

Strolling down Bond Street—perhaps the main luxury shopping street in London—I was exploring the shop windows. The Christmas decorations, which had captivated the imagination and instilled a sense of festivity since November, had been removed, and new ones had taken their place. Here was a very commercial one, perhaps too straightforward, with a "Sale" sign from Boss; there was one so bright that, against the rainbow backdrop, you hardly noticed the mannequins from Dior; and there was one so lively from Hermes that the suspended jackets and bags seemed about to move.

I intentionally stopped near Gucci—curious to take a look at the much-discussed global concept "Endless Narratives." Why was it so talked about? Unprecedentedly, it was commented on by Gucci's CEO Stefano Cantino, and the news had made it onto all major and minor fashion media outlets. I can imagine the amount of resources thrown into achieving such a unified narrative about a window display. If you know what I mean (I bet you do).

My gaze wandered disappointedly across the gleaming glass, failing to spark any lively interest. The bustling street felt semi-empty, and, with a barely perceptible sigh, I was already heading for coffee at Ralph Lauren. Typically, the street tables there are always occupied, yet now, several sat invitingly vacant.

Suddenly, I froze. Flowers had blossomed from a small window—delicate yet vivid. I felt the breath of spring in the air, my favorite time of year. Perhaps it's because of my birthday, or perhaps because spring always feels like a delicate yet inevitable celebration of life, the birth of something new. Above the flowers, an exotic bird fluttered its wings. At the center of it all, a diamond necklace caught the light, radiating brilliance.

I lingered at this small window for several minutes, absorbing every detail. It belonged to the Van Cleef & Arpels boutique—perhaps the only one on all of Bond Street that seemed to breathe with spring and the promise of new life.

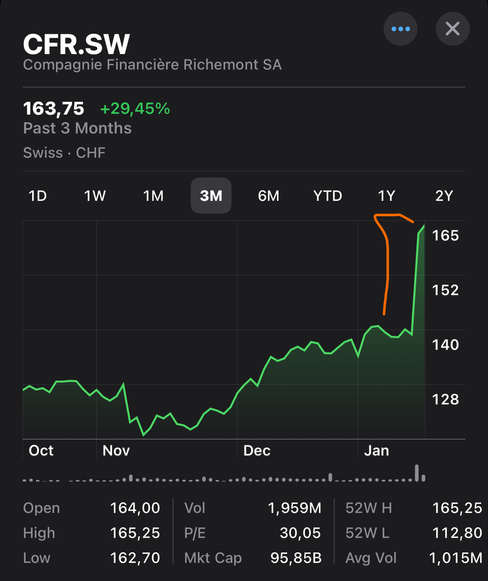

This week, the owner of Van Cleef & Arpels, Richemont, released a financial report. Similar to this window display, the results from Richemont breathed life into the sagging luxury market. Literally—a number of luxury groups and brands saw their stocks make a quantum leap.

With most of January 2025 behind us, I am curiously observing how the luxury business is recovering from its prolonged depression. How successful these efforts are—and just how deep the downturn was—will soon become clear from the upcoming reports of other market players.

In this edition I also couldn’t let slip the recent La Lettre report about how LVMH-owned Moët Hennessy continues to be sold in Russia despite sanctions. As this topic feels personal to me, I took a closer look at the nature of the sanctions affecting the luxury market.

So, grab your favorite espresso (or perhaps a glass of champagne), settle in, and let’s explore the chic, the influential, and the simply fascinating moments from the past week.

x Marina 2Jour

5. Profit Watch: Tracking Financial Wins and Losses

TikTok Reinstated in U.S. Following Brief Shutdown Amid Legal Turmoil

In a dramatic turn of events, TikTok has resumed operations in the United States after a brief 14-hour shutdown. The resumption occurred shortly after President-elect Donald Trump expressed support for the platform during a rally on Sunday, signaling an end to the nationwide ban that had just taken effect. Trump, who is set to take office on January 20, 2025, has promised to halt the ban by extending the deadline for TikTok's parent company, ByteDance, to divest its U.S. operations.

This development comes amid legal challenges and national security concerns that led to a Supreme Court ruling upholding the federal law that initially banned the platform. The reinstatement marks a significant victory for TikTok and its approximately 170 million American users, who rely on the platform for digital marketing, consumer engagement, and social interaction.

The ban may not only impact luxury brands but also small businesses and larger enterprises that have leveraged TikTok’s unmatched ability to create viral moments. This highlights the fragility of digital strategies heavily reliant on a single platform and underscores the necessity for brands to diversify their digital presence.

Kering Sells Prime Paris Properties for €837M. A Move Toward Real Estate Diversification?

Kering has announced a significant €837 million deal with Ardian, selling a 60% stake in three prestigious real estate properties in Paris, including the Hôtel de Nocé on Place Vendôme and two buildings on Avenue Montaigne. The luxury group will retain a 40% stake in the properties, securing vital retail spaces without tying up substantial capital indefinitely.

This deal aligns with a broader trend in the luxury industry, where securing prime real estate has become critical to enhancing brand prestige and attracting affluent shoppers. However, these investments often require significant resources, leading companies like Kering to seek partnerships to balance asset management with growth strategies. Despite facing challenges such as a 38% drop in shares over the past year and performance issues at Gucci, Kering remains focused on maintaining its competitive edge through strategic investments and partnerships.

Amidst challenges such as declining shares (-38% over past year) and struggles at Gucci, Kering has remained committed to anchoring its brands in premium locations. This deal follows significant investments, including €1.3 billion for a property on Milan's Via Monte Napoleone and nearly $1 billion for a building in New York.

According to chief executive François-Henri Pinault Kering does not aim to operate as a real estate developer.

“Once a brand is making over €3bn in sales [referring to SL], these [kinds of locations] become indispensable,” he told reporters in February 2024. But “just because a building is available in a premium location, it doesn’t mean we’ll buy it. We will take it only if it makes sense.”

Ardian is a leading global private investment firm managing or advising $176 billion in assets for over 1,720 clients worldwide. With expertise in private equity, real estate, and credit, Ardian offers tailored investment solutions and focuses on creating long-term value. Headquartered in France, the firm operates across 19 offices in Europe, the Americas, Asia, and the Middle East.

Luxury Finds A Way: Moët Hennessy Still Flowing in Russia Despite Sanctions

Despite LVMH's suspension of direct operations in Russia following the country's invasion of Ukraine in March 2022, recent reports indicate that Moët Hennessy products have continued to reach the Russian market through third-party distributors. French investigative media La Lettre reported that Moët Hennessy collaborated with two U.S.-based duty-free distributors to facilitate these shipments.

In response, an LVMH spokesperson stated that controlling the final destination of products sold by third-party distributors is "impossible," emphasizing that Moët Hennessy and its partners "scrupulously comply with the laws, rules, and international sanctions in force on products marketed wherever they operate."

My thoughts on why such news feels very wrong to me, as well as why the PR communication failed, are shared here.

Andrea Guerra, CEO of Prada Group, in an interview for BOF: ‘Luxury Must Make People Dream’

People don’t just want a tag; they want to live inside a brand.

I was reading an interview with Andrea Guerra, CEO of Prada Group, for BOF, and this particular phrase made my eye twitch. It's not like people absolutely don’t care, but the supposed desire for belonging to the "insides" of a brand has always struck me as somewhat illusory. An illusion created by the brands themselves. However, it’s even more interesting to hear such sentiments from the CEO of a group whose significant success in the past year has been driven precisely by tags—sewn not only on the inside but prominently displayed on other visible parts of items.

Obviously, tags were not the only one driver for Prada Group, which is one of the few in luxury sector currently demonstrating positive and tangible growth. Some insights and points I found interesting:

Prada faces economic headwinds in China, with recovery anticipated to remain slow through 2025. Despite this, Guerra expressed confidence in the long-term growth potential of Chinese consumers and the region's importance to the brand;

Guerra highlighted hyperinflation in leather goods pricing, noting that some luxury brands raised prices significantly without offering proportional value to customers. This has strained consumer trust and contributed to shifting priorities away from bags toward experiences. Prada recognizes the need to create products that justify their price by delivering both quality and the “dream” associated with luxury. Guerra emphasized avoiding alienating aspirational consumers and ensuring that core customers always feel comfortable within the brand’s world. In this context, I’d like to mention that Prada Group is one of the few with a balanced category sales mix. Leather goods accounted for around 50% of its revenue in 2023, compared to more than 70% at Saint Laurent and Bottega Veneta (my in-depth research on revenue distribution by product category in major luxury groups is available here);

The popularity of leather goods has peaked, with many consumers opting to spend on experiential luxury, such as travel and high-end hospitality, rather than accumulating more physical products. Prada is adapting by diversifying its offerings, including ready-to-wear, footwear, and experiential elements that integrate lifestyle with traditional luxury;

The luxury sector is undergoing a "turning point," with many brands facing creative and leadership instability. Guerra acknowledged the challenges of competing with resource-rich conglomerates like LVMH but stressed the importance of agility, differentiation, and strong partnerships with stakeholders, including landlords and real estate partners;

Prada is shifting away from its historical focus on product and brand image to prioritize customer relationships. Stores are being transformed into immersive spaces that connect customers with the brand’s culture, values, and creativity;

Guerra anticipates continued challenges in the first half of 2025 but remains optimistic about luxury’s resilience. Prada aims to outperform industry averages by leveraging its strong cultural relevance, sustainability initiatives, and a commitment to offering products and experiences that inspire dreams.

PROFIT WATCH: TRACKING FINANCIAL WINS AND LOSSES

Brunello Cucinelli Reports 12.2% YoY Growth in 2024

Brunello Cucinelli reported preliminary results for FY24: €1.278 billion in revenue, a growth of +12.2% YoY (+12.4% at constant exchange rates).

Regional growth:

Americas: +17.8% YoY (€476.5 million, 37.3% of total revenue).

Asia: +12.6% YoY (€345.4 million, 27.0% of total revenue).

Europe: +6.6% YoY (€456.5 million, 35.7% of total revenue).

In this context, I am particularly impressed by the strong local demand for the brand, with Italy accounting for 11.3% of total sales. Equally noteworthy is the continued growth in Asia (+12.6%), especially as many other luxury brands report significant slowdowns in the region. It would be fascinating to see how much of this growth is driven by Japan, which has recently emerged as a standout performer in the luxury market.

Sales Channels

Retail channel: €851.2 million (+14.0%), "driven by double-digit growth and the launch of a new AI-powered website in mid-2024";

Wholesale channel: €427.2 million (+8.8%).

Brunello Cucinelli ended FY24 with 130 boutiques, an increase from 126 boutiques as of June 30, 2024. Additionally, the company operated 50 hard shops by the end of the year, reflecting continued selective expansion to strengthen its retail presence.

Strategic Investments

Investments totaled €108 million in FY24 (8.5% of turnover), aimed at expanding production facilities, digital innovation, and boutique upgrades;

The Solomeo headquarters doubled its size, with further expansions planned.

Financial Health

Core net financial debt stood at approximately €105 million, despite significant investments and €66 million in dividends (50% payout).

Future Outlook

The brand projects 10% annual revenue growth for 2025 and 2026, targeting to double 2023 turnover by 2030.

Luxury’s Bounce Back? Richemont Reports +10% YoY Growth

This week, Richemont became the first of the major luxury groups to deliver results for Q3, which ended on December 31, 2024. A +10% YoY growth—impressive. Overall, the group’s presentation and press release provide a solid overview of the details, so I won’t rephrase them in my own words. Instead, I’ll remove any subjective evaluative adjectives for a more fact-based summary and highlight what caught my attention.

1) Q3 sales increased by 10% at both constant and actual exchange rates.

Quarterly sales reached €6.2 billion, the highest ever recorded.

Regional performance: Double-digit growth in the Americas, Europe, Middle East & Africa, and Japan. Sales in Asia-Pacific declined by 7%, with an 18% drop in Mainland China, Hong Kong, and Macau.

Business areas: Jewellery Maisons grew by 14%, Specialist Watchmakers declined by 8%, and the 'Other' category grew by 11%, including a 7% increase in Fashion & Accessories Maisons.

Channels: Retail sales increased by 11%.

2) 9-month sales reached €16.2 billion, a 4% increase at constant exchange rates and 3% at actual exchange rates.

3) Net cash position: €7.9 billion.

Regional Performance:

Europe: Sales rose by 19%, driven by higher domestic demand and increased tourist spending. France, Switzerland, and Italy saw notable increases;

Americas: Sales increased by 22%, supported by demand across all business areas;

Japan: Sales grew by 19%, with contributions from both tourists and local customers;

Middle East & Africa: Sales rose by 20%, led by the UAE;

Asia-Pacific: Sales declined by 7%, with Mainland China, Hong Kong, and Macau down by 18%. Other markets in the region, including Korea, showed growth.

Distribution Channels:

Retail Sales: Increased by 11%, contributing 71% of total sales;

Wholesale Sales: Rose by 4%;

Online Sales: Increased by 17%.

As someone strongly interested in e-commerce, these results for online retail intrigued me because:

1) According to the presentation, this growth was particularly driven by the Jewellery Maisons. I find jewellery especially challenging to sell online for several reasons—starting with technical nuances such as secure delivery and establishing efficient return/exchange services;

2) These results could indicate that Richemont’s e-commerce strategy is on point, that customers are shifting their luxury shopping experiences to digital platforms, or perhaps a combination of both.

This could also mean there is potential for further expanding sales online, making it crucial to continue developing a strong online presence. As I’ve mentioned before, I don’t view e-commerce as separate from offline retail; rather, I see it as an integral part of the overall customer experience, where omnichannel strategies form a robust foundation for strong sales.

Business Areas:

Jewellery Maisons: Sales grew by 14%;

Specialist Watchmakers: Sales declined by 8%;

Other Business Areas: Sales grew by 11%, with Fashion & Accessories Maisons increasing by 7%. Watchfinder & Co recorded double-digit growth.

In such reports, the standout performers are usually highlighted. Chloe’s absence here suggests that its fresh start may not have translated into strong sales. Alaïa, on the other hand, continues to shine—its previous report mentioned double-digit growth in the USA and included two of its best-selling items: ballet pumps and the dachshund bag.

Seeing Peter Millar mentioned in the context of continued growth brings a smile to my face. Johann Rupert, as I discovered recently (did a small background research, including interviews and biography, after enjoying the Financial Times video I wrote about earlier), has a passion for golf. While I’m not claiming this is the sole reason why a golf-focused brand is part of the group’s portfolio, I can’t help but think there’s a connection here. I love stories where personal interests align with financial success.

It’s also curious to see Watchfinder mentioned on the list. As much as I’m not into blindly following McKinsey, Bain, etc., luxury predictions and data, they are among many in the industry pointing to the growing potential of vintage and pre-loved in luxury. So, we just note the trend.

To better observe the trend, here are the tendencies over the last two years (ideally, Q4 2024 would be included, but it is what it is:). I prefer to consider structure rather than just dry numbers to evaluate how healthy an activity is and how vulnerable it may be to fluctuations.

+10% YoY has sown a seed of hope among luxury investors. Stocks of LVMH, Kering, Hermès, and others made an unprecedented leap—perhaps the largest since the surge in September when the China economic stimulus was announced.

These +10% also became the main argument supporting the idea of a luxury market recovery. But is everything really returning to normal? I have my doubts, as I see the reasons for the current market pullback not only in global challenges but also in structural problems that have been building up for years. Some questions remain unanswered and provoke thought:

If we look at the number of purchases rather than their total value, what are the factors and trends behind such growth? This includes the context of pricing (as price increases mean fewer units need to be sold to achieve a certain revenue) and the quantitative volume of purchases (whether the number of luxury consumers is increasing or decreasing);

How is demand distributed across different price categories: entry-level highly accessible jewelry, mid-segment, and high jewelry?

What are the trends among other major jewelry brands like Bvlgari and Tiffany & Co., independently-owned brands like Graff or Chopard, as well as brands whose jewelry lines are offshoots of their main revenue streams (e.g., Dior, Louis Vuitton, Hermès)?

Of course, some of these questions can only be answered by Richemont, while others are akin to reading tea leaves. But they would undoubtedly provide a much more comprehensive picture of the market and offer deeper insight into the steps that led Richemont to achieve such results.

THE JOB SHIFT JOURNAL: HIRES, FIRES & TRANSITIONS

Proenza Schouler Founders Announce Departure. To move to LOEWE?

Jack McCollough and Lazaro Hernandez, the founders and creative directors of Proenza Schouler, will step down from their roles on January 31, 2025. While leaving their creative positions, they will continue as board members and shareholders. The company’s CEO, Shira Suveyke Snyder, is overseeing the search for their replacement, as the brand navigates its next chapter.

Proenza Schouler is a New York-based womenswear and accessories brand founded in 2002 by Jack McCollough and Lazaro Hernandez. The duo met at Parsons School of Design, where their senior thesis became their debut collection, purchased in its entirety by Barneys New York. The brand's name combines the designers’ mothers’ maiden names, symbolizing a personal touch.

Industry speculation suggests McCollough and Hernandez may take on new opportunities in Europe, with rumors linking them to potential roles at Loewe. Last year's rumor meanwhile suggests that Jonahtan Anderson, current creative director at Loewe will move forward to Dior. Maria Grazia Churi may move to Gucci.

Another round of musical chairs is on, which culminated, perhaps, in the main appointment of last year—Matthieu Blazy at Chanel (from Bottega Veneta). I hardly feel like commenting on it as everything was told before me, except for the following thought.

Beyond the essential components like talent and well-thought-out collections that not only respond to market demand but also shape the agenda for that demand, resources have become critically important. This makes the existence, let alone the scaling, of independent brands a significant challenge—one that even those who establish these brands are often not prepared to take on. Especially that taking on a challenge doesn’t necessarily mean victory.

The remaining question is whether the duo could continue working on both brands, like Jonathan Anderson (interesting if he ends up at Dior, would he still work at JW Anderson), or David Koma, who splits his time between his namesake brand and Blumarine.

The Struggle of Luxury Brands in Sanctioned Russia

On February 24, 2022, I woke up at 4:42 AM. It wasn’t an early alarm, nor insomnia, although I had been struggling with deep sleep over the past few days. The tension from conversations about an invasion had been building. Every day, the news documented Russia amassing troops along the borders. Like many Ukrainians, I didn’t believe it would become anything more than muscle-flexing, a bluff. But I still slept bad.

I woke up to a deafening crash and rushed to the window. An eerie silence. Through the heavy, dark sky, the first rays of light began to break through. Frantically, I opened browser tabs in search of news and stumbled upon a live video of the Russian president declaring war on Ukraine.

I started calling my dad. He was in another city, and my call woke him up.

—Dad, the war has started,

—I blurted out, then fell silent. On the other end of the line, there was silence too.

Despite having a good memory, I’m bad at remembering dates that bring bad things into my life. Perhaps it’s a protective mechanism. But I will always remember that crash in the early morning of February 24, 2022, which turned out to be the sound of rocket debris falling, shot down just 3 kilometers from my house. No, not because my life became different that day, like the lives of all Ukrainians. February 24 has always been a good and important day for me. It’s my dad’s birthday.

***

The war did not start on February 24, 2022. It began in 2014 with the annexation of Crimea and the military invasion in the Donbas region in eastern Ukraine. That was explained by "saving those who suffered there," but I see it more as a greedy grab for a piece rich with mineral deposits. Donbas has been especially known for mining, with huge reserves of coal, iron, and manganese ore. What happened on February 24th 2022 was a full-scale aggression.

What Are Sanctions?

In response to Russia's invasion of Ukraine, the response in the legal and diplomatic fields has been sanctions. The EU explains sanctions as:

...a tool [...] to uphold international law, prevent international crises, support conflict resolution, fight terrorism and tackle the proliferation of weapons. Sanctions are a useful tool to support third countries consolidate democracy and the rule of law and to hold violators of human rights accountable for their crimes.

The U.S. Department of the Treasury’s Office of Foreign Assets Control considers sanctions [against targeted foreign jurisdictions and regimes, as well as individuals and entities engaging in harmful activity, such as terrorists, international narcotics traffickers, weapons of mass destruction proliferators, and other malign actors], as

response to threats to the national security, foreign policy, or economy of the United States.

What Do Luxury Sanctions on Russia Mean?

One of the key documents regulating these luxury sanctions is Council Regulation (EU) 2022/428 of 15 March 2022. According to Article 3h of the Regulation:

It shall be prohibited to sell, supply, transfer or export, directly or indirectly, luxury goods, whether or not originating in the Union [...] to any natural or legal person, entity or body in Russia or for use in Russia.

The ban also applies to luxury goods originating from non-EU countries that transit through the EU to Russia, even if the originating countries have not implemented similar sanctions. This prohibition includes all transportation activities involved in transferring these goods across EU territory.

Luxury goods are identified as those whose value exceeds EUR 300 per item.

Annex XVIII to the Regulation provides a complete list of luxury goods referred to in Article 3h. The list includes wines (including sparkling wines), beers, spirits, and spirituous beverages (referring here to to Moët Hennessy), as well as luxury fashion items, jewelry, cars, and so on.

How Luxury Finds a Way Despite Sanctions

While exploring this theme further, I came across two Financial Times articles from the end of December. The first one discusses the boom in middleman services—personal shoppers purchase sanctioned luxury fashion and jewelry mostly in Europe and then transit them to Russia. The other article describes how luxury cars with the latest engines are available for sale in Russia.

I'll explain a bit about how personal shoppers operate in Russia in practice. Personal shopping services didn't emerge as a new entrepreneurial approach with the onset of sanctions. Shoppers have been active since before 2022—if a product was not available in Russia and the buyer wasn't planning to visit Europe soon, they would use such services. A shopper's earnings typically include not only the tax-free amount (which Russian buyers can no longer obtain) but also a commission on the price of goods from European boutiques, usually 10-20%. The commission can be much higher, depending on the rarity and desirability of the goods and the resale market prices.

Shoppers sell their services via Instagram and Telegram, posting updates that often include real photos of the products and fittings. At their own risk, they often go through the "green corridor," meaning the goods are not officially declared for further tax payment. Periodically, I come across stories about fines and confiscation of goods related to such tricks. If delivered in parcels, the value of luxury goods is mostly understated.

Direct luxury clients with Russian passports indeed face difficulties in making purchases independently. However, this is not always the case. From the information I've encountered, including in anonymous chats, some brands ignore sanction restrictions, while others' policies depend on the country and city. I do not possess firsthand details of the brands' policies.

Another scheme is described in the same Financial Times article. For example, suits from the Italian brand Canali are still available at perhaps Moscow's main luxury shopping center, TSUM—Russia's answer to London's Harrods, if one were to make comparisons. How do suits, whose cost significantly exceeds 300 euros, reach Russian shelves? Surprisingly, their declared cost for customs is less than the stated 300 euros.

A loophole, which according to their representative, LVMH and Moët Hennessy cannot control, is when distributors from countries that have not officially ratified or implemented sanctions sell to Russia.

Why Luxury Tries to Find The Way

In addition to the luxury market crisis, which is linked to numerous factors but ultimately signifies a decline in customer base and sales in a rather aggressive industry (the sparkle of rhinestones shouldn't distract from the fact that fashion is a business, albeit one clad in cashmere), each client is crucial. This is especially true for UHNWIs.

What I will write next is my personal assessment, based on a reasonably good understanding of the realities in post-Soviet countries. I tried to find statistics to support what I will discuss next, but again, given the realities, this is a challenging task.

So, here it is. Russia virtually lacks a middle class. The population is either very poor or fabulously wealthy. If you open the Forbes list of billionaires, as of today there are 122 billionaires in Russia out of 2743 in the world, which is 4.44%. Most of them made their wealth from resources (just saying).

So, 122 potential clients plus their families, who mainly prefer a lavish lifestyle and the display of wealth. No wonder high jewelry brands invite Russians to their private events—after all, as far as I know from not long ago, they leave with necklaces worth over 1 million euros.

How significant is the contribution of UHNWIs to luxury brand revenues? I have come across various estimates from different sources—for example, 10% of such clients account for 40% of sales. Naturally, this information is often proprietary, but its frequent mention by industry representatives themselves is quite telling.

Add to this the 380,000+ dollar millionaires, and the allure of luxury becomes more than clear.

Number of USD millionaires (*UBS Wealth report 2024)

Number of USD millionaires (current and forecast) | |||

Country | 2023 | 2028 | Change (%) |

United States | 21 951 319 | 25 425 792 | 15,83% |

Mainland China | 6 031 282 | 6 505 669 | 7,87% |

Spain | 4 180 703 | 4 327 197 | 3,50% |

United Kingdom | 3 061 553 | 2 542 464 | -16,96% |

France | 2 868 031 | 3 322 460 | 15,84% |

Japan | 2 827 956 | 3 625 208 | 28,19% |

Germany | 2 820 819 | 3 229 283 | 14,48% |

Canada | 1 991 416 | 2 402 200 | 20,63% |

Australia | 1 936 114 | 2 334 015 | 20,55% |

Italy | 1 336 142 | 1 689 235 | 26,43% |

South Korea | 1 295 674 | 1 643 799 | 26,87% |

Switzerland | 1 054 293 | 1 257 334 | 19,26% |

India | 868 671 | 1 061 463 | 22,19% |

Taiwan | 788 799 | 1 158 239 | 46,84% |

Hong Kong SAR | 629 155 | 731 716 | 16,30% |

Sweden | 575 426 | 703 216 | 22,21% |

Belgium | 564 665 | 653 881 | 15,80% |

Russia | 381 726 | 408 487 | 7,01% |

Brazil | 380 585 | 463 797 | 21,86% |

Saudi Arabia | 351 855 | 403 874 | 14,78% |

Singapore | 333 204 | 375 725 | 12,76% |

Mexico | 331 538 | 411 652 | 24,16% |

Norway | 253 085 | 306 247 | 21,01% |

United Arab Emirates | 202 201 | 232 067 | 14,77% |

Israel | 179 905 | 226 226 | 25,75% |

Indonesia | 174 605 | 235 136 | 34,67% |

Portugal | 171 797 | 189 235 | 10,15% |

Netherlands | 121 625 | 4 179 328 | 3336,24% |

Thailand | 100 001 | 123 531 | 23,53% |

South Africa | 90 595 | 108 557 | 19,83% |

Chile | 81 871 | 95 173 | 16,25% |

Greece | 80 655 | 80 295 | -0,45% |

Turkey | 60 787 | 87 077 | 43,25% |

Kazakhstan | 44 807 | 60 874 | 35,86% |

Qatar | 26 163 | 29 977 | 14,58% |

Hungary | 24 692 | 29 260 | 18,50% |

*UBS Wealth Report 2024Do brands understand that they are selling items to shoppers with the final destination Russia in mind? Of course. After all, shoppers as a class are very easy to identify. Just look at the extensive purchase history with completely different sizes, styles—here, potentially suspicious transactions become immediately obvious. But it is painful to turn away those who can make a good profit with just one purchase, is not it? Even if it a direct violation of regulations. |

Much To Lose?

Russia is not the main player in the luxury market, especially compared to the USA and Asia. Besides moderate revenues, those who find loopholes risk facing more serious problems—not only reputational risks but also fines, confiscation of funds and resources obtained illegally, as well as corporate and personal liability, including criminal charges for those directly involved in the schemes.

I assume that if the competent authorities have a strong desire to find such violations in luxury and set a precedent, the violations will be found.

How To Deal With Sanctions: Communication

I understand (although I don't support) how luxury brands may be struggling in the context of adopting the legal stance established by regulatory acts.

If we're not talking about breaking the law, but rather following the law, I would halt the prohibited operations mentioned above. An essential part of implementing such a policy should be guidelines for dialogue with those to whom these items cannot be sold—without hostility, in simple 'understanding' language. The blame for the decision can easily be shifted onto governmental bodies—this will reduce the degree of anger directed at the brand itself.

When the war in Ukraine ends and the sanctions are lifted, the aggrieved customers will not seek alternatives.

Do Sanctions Actually Work? What Do They Have to Do with Luxury?

The framework of sanctions is designed such that their impact unfolds over time, in the long term. This is also due to the fact that when implementing sanctions, countries need to restructure processes that may involve the sanctioned country. For example, Russia was one of the largest gas suppliers to several European countries and had an extensive infrastructure for its transportation, which made them dependent.

Moreover, there are always those who look for (and find) loopholes in the legislation to continue their usual operations to make money. This acts as a brake on sanctions and slows their effect.

However, sanctions do work. Initially, time is needed for their full implementation, then for the gradual depletion of the resources of the economy of the sanctioned country. At some point, a collapse occurs—a domino effect. We are already observing how the dominos fall. This supports worldwide compliance without using military force. The collapse will further strengthen the positions of Ukraine and its partners, who are also interested in their own security—whether in negotiating or military stances.

Banning luxury goods through sanctions aims to economically and socially pressure influential figures and the elite in a targeted country, encouraging policy changes. Returning to the Forbes list and looking at sources of income, a clear trend can be identified. Wealth is often determined by proximity to resources. And if there is proximity to resources, it very often also means closeness to those who make decisions.

***

If we disregard the "understanding" of luxury brands' struggles, their attempts to circumvent existing restrictions also speak to me of the insufficiency of their medium- and long-term strategies, as well as the difficulties of adapting tactics from theory to practice. There are no perfect conditions written on paper in real life, but there is the ability to adapt to challenges and complexities. Or is there not?

In the context of sanctions, violations are nothing less than putting corporate interests above national ones. And it is in the national interest that they were implemented. It may seem that all of this is very far away. I, too, did not believe that February 24, 2022, could happen in that way.

Stay tuned for the next week edition x